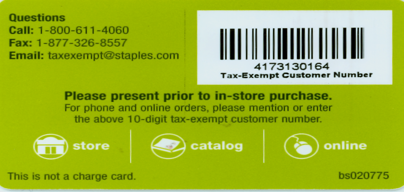

staples tax exempt certificate

If the delinquency date falls on a. Do not use grayed-out lines.

2A 299 tax rate for vessels motors for vessels trailers used for transporting a vessel and dyed diesel marine fuel.

. A good example is Bethanys soap-making business. LOS ANGELES COUNTY TAX COLLECTOR PO. Thus while a Reeses Peanut Butter Cup may be subject to sales tax a Kit Kat bar or Twix bar would be exempt or taxed at a reduced rate for food and food ingredients.

To request a one-year waiver from the electronic filing requirement visit portalctgovDRS and complete. If you are registered for sales tax. Fax your tax certificate to Staples at 18888238503.

On a cover sheet please include your telephone number and order number if applicable. Candy and soft drinks have been taxed at the regular state and local sales and use tax rate since January 1 2018. A 1 tax rate for computer and data processing services.

Qualified or registered to do business in. Please do not write on your tax certificate. Contractors-Sales Tax Credits Tax Bulletin ST-130 TB-ST-130 Printer-Friendly Version PDF Issue Date.

Do not use staples or other permanent bindings to assemble the tax return. 3A 45 tax rate on the sale of a motor vehicle to a. You will be prompted to provide this information during checkout and will be given a link to a printable fax cover sheet.

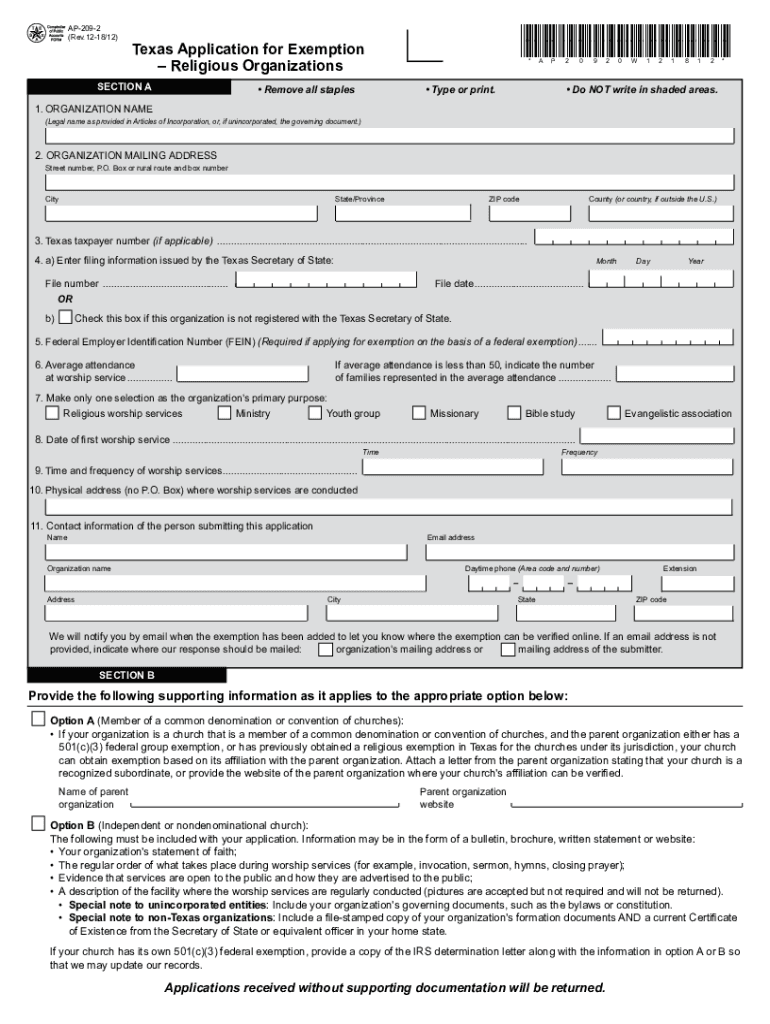

Such an organization might still qualify for exemption from Texas sales tax and franchise tax if applicable based on their exemption under certain sections of the Internal Revenue Code IRC. Tax Bulletin ST-107 TB-ST-107 Printer-Friendly Version PDF Issue Date. H R Block Tax.

Deduct the total of all exempt sales from gross receipts. Ontario Ministry of Finance form 0169 completed. BOX 54018 LOS ANGELES CA 90054.

Incorporated or organized in California. Updated June 13 2014 Introduction. E A purchaser of a taxable item who gives an exemption certificate is not liable for the tax imposed by this chapter if he donates the taxable item to an organization exempted under Section 151309 or 151310a1 or 2 of this code.

Pacific Time on August 31You can make online payments 24 hours a day 7 days a week until 1159 pm. Exempt status under this category. Street RR or P.

Express Tax N Insurance. Box City State Zip 4. Those rules underwent several rounds of revisions after receiving useful feedback from a wide variety of.

5450 West Broad Street Richmond VA 23230 804 288-7443. Do not attach staples clips tape or correspondence. Once your certificate is approved you can make eligible tax-exempt purchases in our stores.

A letter from lawyeraccountant outlining the stated capital of all classes and series of shares of the corporation the number and stated dollar. If you are a tax-exempt organization and do not have a Staples Tax-Exempt Customer Number please follow these steps. Cartons containers wrapping and packaging materials and supplies that a vendor uses in packaging tangible personal property for sale are exempt from sales tax when these materials are actually transferred by the vendor to the purchaser.

In planning their course of studies students are encouraged to focus on their own individual. Most states accept the Uniform Sales Use Tax Certificate as a reseal form but some states require special ones. Is exempt from Kansas sales and compensating use tax for the following reason.

Use Percentage exemption to exempt a percentage of fuels or energy based upon consumption. The taxpayer or local assessing officer may request a meeting to discuss the issues presented by the. H R Block Inc.

She buys the ingredients to make her soap from local farms and producers. 6003 Staples Mill Road Richmond VA 23228 804 288-7419. To check out with a tax-exempt purchase log into your account in the portal find your applicable tax-exempt certificate and click on Checkout Barcode The store associate will key this barcode into the register during checkout.

For purposes of this. To buy items exempt from tax you must give the vendor a completed Form ST3 Certificate of Exemption. Businesses still must pay a sales tax on goods used for its business the exemption is only for goods it buys and resells.

Please do not write on your tax certificate. The exemption went into effect July 1 2019. Multiply the receipts subject to the 299 tax rate on vessels motors for.

Fax your tax certificate to Staples at 888-823-8503. Do not use staples or other permanent bindings to assemble the tax return. _____ Business Name.

Entities subject to the corporation minimum franchise tax include all corporations eg LLCs electing to be taxed as corporations that meet any of the following. Certificate of insurance in your name. Sales tax on goods and services purchased for use by organizations exempt under IRC Section 501c3.

Entities subject to the corporation minimum franchise tax include all corporations eg LLCs electing to be taxed as corporations that meet any of the following. Commodity means staples such as wool cotton. A Ministry of Transportation Safety Standards Certificate.

The Department of Revenue engaged in the process of drafting administrative rules to provide binding guidance for taxpayers. Your order will be taxed and a refund. At its core is the notion that the path to success and fulfillment may look entirely different from one student to another.

Except that any use by the purchaser of the taxable item other than retention demonstration or display. Pursuant to California Revenue and Taxation Code Section 2922 Annual Unsecured Personal Property Taxes are due upon receipt of the Unsecured Property Tax Bill and become delinquent after 500 pm. Email or fax us your tax-exempt certificate.

The reason for the exemption is Industrial production to buy items that are consumed in the production process or that are ingredi-ents or components of the final product. Ingredient or component part Consumed in production Propane for. Franchise or Income Tax Corporation Franchise Tax.

Iowa Code section 4233 subsection 16A to exempt the sale of a grain bin from sales and use tax. Do not use staples. As a contractor you generally must pay sales tax to your suppliers when you buy materials and supplies and you must collect sales tax on certain jobs you perform for your customers.

Gladys Young dba Spanish Connection. Incorporated or organized in California. Street RR or P.

If you are a tax exempt organization and do not have a Staples Tax Exempt Customer Number please follow the steps below. Texas tax law provides an exemption from. Massachusetts Community Development Block Grant Program is a federally funded competitive grant program designed to help small cities and towns meet a broad range of community development needs.

Box City State Zip 4 _____ is exempt from Kansas sales and compensating use tax for the following reason. On a cover sheet please include your telephone number and order number if applicable. Staples High School offers a broad and deep curriculum designed to support each student through his or her high school experience and in preparation for the future.

Pacific Time on the delinquency date. 300 Turner Road Suite C D Richmond VA 23225 804 320-5860. AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased from.

Expires 36 days form the date of issue 5. Qualified or registered to do. Franchise or Income Tax Corporation Franchise Tax.

Ingredient or component part. 30 consecutive days or less that are subject to the tax rate of 935. Such communications shall include a signed and dated certificate that copies were provided as required by these Guidelines showing the date of mailing or delivery and the name and address of the addressee.

AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. Payments mailed to an address other than the address listed below including any Assessor Office that are received by the Los Angeles County Tax Collector after the delinquency date are delinquent and penalties will be imposed. 2911 Turner Road Richmond VA 23224 804 447-7632.

H R Block Inc. Column 1 - Multiply the receipts subject to the 1 tax rate on computer and data processing services by9901.

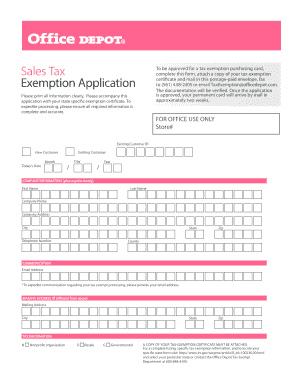

Get And Sign Office Depot Tax Exempt Form

Tx Comptroller Ap 209 2018 2022 Fill Out Tax Template Online Us Legal Forms

Staples Com Customer Service Order Support

Tax Exempt Form Choose By Options Prices Ratings Staples

How To Make Tax Exempt Purchases In Retail And Online Stores How To Make Money On The Internet